Is this an long term investment trend or bubble about to pop ?

UNLESS the price stays up, who's gonna go get the rest?

That's why HilldaBeast anfd FlimFlam sound so fucking stupid when they talk about "windfall profit taxes"

yeah, that'll show em'.

Of course there are some delusional assholes that still think that people like me are part of the problem instead of the only short term solution we have.

Notice, I did say short term solution. The only way to fix the problem long term is to get off fossil fuels, but that solution is many years off, in the meantime we need oil. Taxing out of exisistence, the very people who find it is a solution that only a Democrat would find reasonable

USA can reduce demand realistically. What is the use of 550 HP on a street car?

Believe technology is there to get more miles from car with adequate size and comfort.

Everyone starts to look mat Automobiles as a mode of transportation rather than status symbol or as an extension.............

I wouldn't mind a bit if taxes are imposed on cars after certain HP. Also need to close the loop hole on businesses. Today, any business can write off any type of a vehicle and it should be changed on the type of business. A farmer, a construction contractor have need for high HP heavy duty vehicle, not an insurance agent. Let them have one if they prefer but not on the publics back.

Short term solution is reducing demand and there must political will to do so in creative ways without screwing up everything else. Yes, intelligent solutions are too much to ask from our political nit wits regardless of which damned party it is.

boys are just faster than others?

Have you been taking estrogen supplements? Just asking.

All the countries put together use 84 million barrels a day and the US uses about 20% of that total and then China is next.

China is drilling all over the place for oil. That's what we have to do. We have to drill out in the ocean and up in Alaska in ANWR. There's all kinds of oil. And that oil shale in North Dakota needs to be used.

And we need to build more refineries and more nuclear power plants.

We'd get gas prices down to 2.25 per gallon again.

$0.25/gallon, where it was when I first started driving.

But I'll let you off easy here. You can impress me by talking Jai into chaffeuring me around on her dime.

Shit, I'll even pump the gas.

"Posted by kerrakles, 5/12/USA can reduce demand realistically. What is the use of 550 HP on a street car?

I wouldn't mind a bit if taxes are imposed on cars after certain HP.."

I partially agree.. 550 hp is a bit much for the average consumer.. 500 HP is ample for most sport driving situations..

get off fossil fuels?

You going to just trust that Shell, Exxon, or sombody is going to consider their interest identical to the human race as a whole? (Not suggesting that any gov't is much better here, or even that the human race as a whole is worth saving, but you should see the issue.) Or maybe a voter should take some responsibility and position rather than hoping a force of nature named Shell is going to save their ass?

I doubt that ideology of any kind is going to be very helpful here. Killing 3rd worlders is just a particularly radical form of birth control, which may well be the ultimate solution. (And it's not that we KILL so many, as disrupt their habitat and breeding patterns.) The real problem with that is the total costs may be doing more damage to us than our targets.

I think I'm gonna break out my bicycle. Beats sitting in traffic and swearing.

It's neither. It's a self-fulfilling investment scam. Goldman Sachs research department predicts $200 a barrel oil, the G-S investment people buy oil futures accordingly increasing demand and driving the price to $200.

there will be arrests...

right along Lush Rimjobs involvement in ReCreate68 too...

you ought to know that they'll never prove those folks have brains enough to form specific intent.

Both your points are legit. You will never know, and it's damned handy for those in position to benefit.

there never would have been a subprime mortgage crisis. These guys are human like the rest of us. Noone has a crystal fucking ball, and the experts are wrong just as often as the rest of us. If you're stupid enough to believe everything you read, you deserve exactly what you get.

That said, oil may indeed go to $200 bbl, but not because some anaylist on wall street says it will. If you don't believe me, watch CNBC for a day. For every asshole predicting one thing, there is another asshole predicting the exact opposite.

something very specific, and also a general result, but not know exactly when is too much.

A lot of economic shit can be explained by realizing that there is always the idiot who has to go for the last nickel, if for no other reason than the individual interest is different from the industry interest.

The futures market can only drive the price to a certain extent. The law of supply and demand of the underlying commodity will eventually balance the price.

Lets go with your theory for arguments sake. GS traders buy oil futures with a passion eventually driving the price up to $200, to do that they would have to buy millions upon millions of barrels to have such an impact on the price, but the only thing they have done is drive the demand for the futures contracts not the demand for the actual oil.

So at any rate, your GS traders bid the price of July oil up to $200 per barrel, WTF do you think happens when the real demand for that oil proves to be nonexisent? GS loses their fucking ass is what happens. Sheesh it's not that fucking difficult.

Didn't you learn anything from the Hunt Bros. It's one thing to drive up the price, it's quite another to bid up the price AND get out with your skin. The world uses about $10 billion a day in oil, it's an awfully big market to try to corner, even for GS

I know they tried to "corner" the silver market but their efforts had spillover.

Of course the super inflation was really all Carter's and Nixon's fault.

-- Modified on 5/12/2008 9:08:12 PM

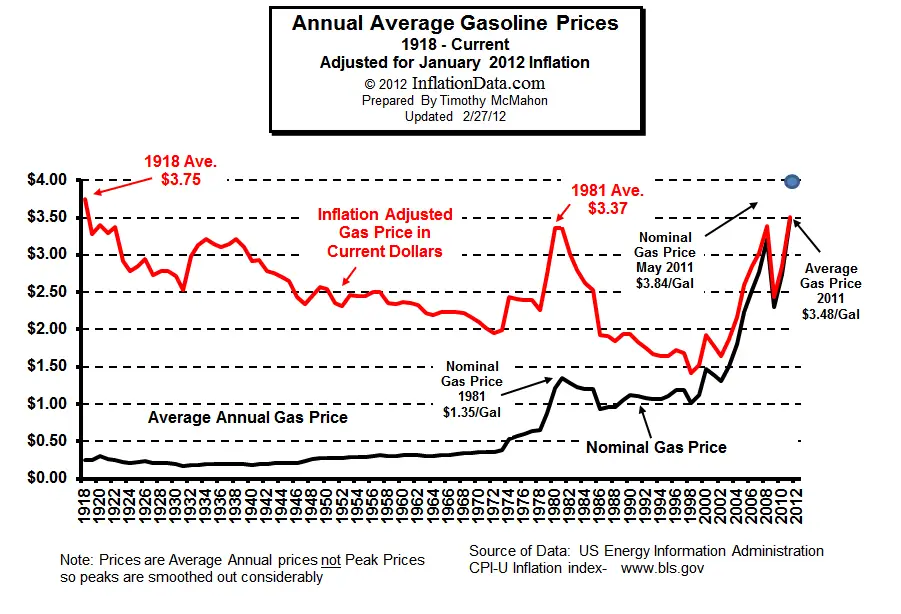

jack0? Are you willing to accept $2.25/gallon instead of $0.25? 'Cause that's what inflation adjusted prices would be since the 25 cents of the 50's and 60's.

I do agree that futures speculation has been the primary inflator of recent prices. Too bad futures trading can't be banned. If the inflation is truly a man made bubble, then prices will come back down. That is, unless the government doesn't step in with some new stupid move with all sorts of unintended consequences.

-- Modified on 5/12/2008 4:35:57 PM

That sounds more like Leftwingunderground speaking. Futures trading provides a necessary fluidity to the markets. Without it there would be no ability to hedge, a very necessary strategy for both producers and consumers alike. Successful hedging of jet fuel prices is what kept Southwest Airlines ahead of the competition. Farmers have been using the futures markets to protect themselves from volatile flucuations in price for decades.

Cmon RWU, don't go all socialist on us

something is outta whack. I don't know what, but the futures market seems to have too much power right now. What should be the natural limiting factors of it's power (other than the natural popping of the bubble after the fact)?

Taxing the oil compaines is the wrong thing to do. An increase in refinery capability would help.

-- Modified on 5/12/2008 5:23:26 PM

I'll cut you some slack because I doubt you meant it literally, but at any rate the futures market doesn't control the price of gas or the spot price of oil anyhow, which is the price that producers actually receive.It merely predicts the price going forward, and is a great place for Gamblers to hang out.

I agree that an increase in refinery capacity would be a good thing, but it won't have any effect on crude products, only refined ones.

the reason you should believe him is because no right-winger ever knows WTF he's talking about, nor ever means what he says. They're just sort of frothing at the mouth insane.

from hedge funds have goatfucked the food business buy driving up prices way beyond what the underlying fundamentals of the products warrant.

granted, it is exacerbated by unprecedented new demand from those fucking Hindus and Chinks but there are new participants in the food commodities markets with LARGE amounts of primarliy LONG money

hmmmm....

Free markets work pretty well, as long as they are free.

Problem is that markets have suicidal tendencies - competitors love to kill each other. In fact, that's the idea. Getting in bed with each other creates cartels and 3rd world arrangements which do NOT work so well.

Yeah, regulation can be a PITA, and often misconceived. OTOH, regulatory agencies are often in bed with the industry. And whether competition works for or against the consumer is an issue of fact (see eg the various multiple listing services).

But the US securities & commodities markets work as well as they do only because they are regulated enough that it's not just an incestuous little Daddy Warbucks club trying to fuck each other. IOW, there has to be some minimal rules of what's fair play, and that while fucking the public at large may be good clean fun, it's bad for business in the long run.

So our own Sherman act has a pretty good and reliable history, while other countries don't have that sort of record, instead relying on the local warlord (like in lots of the 3rd world) or the bureaucrats (like in Europe) all of which gets them where they want to go, but doesn't have the depth and resilience to finance multiple pointless and indefinite wars, like the US economy.

i've only gotr so much upstairs to begin with...

all i'm saying is i don't know enough about how these markets function and how they are regulated to be in a position to suggest what type of changes, IF ANY would be needed to address the problem I cited.

lets just say i participate in a group the buys "quite a bit" of grain so i'm quite aware of what;'s happening on price...its just difficult to be precise in properly attributed causes from effects...

Go back in history and find out why we have a futures market. Believe or not it keeps supply/demand in check for commodity producers.