Part of the Laissez Faire economy of the 20's.

Btw,I havent read "The Turner Diaries" or "Dianetics" either---------------![]()

-- Modified on 2/24/2011 7:01:50 PM

...are probably the ones so disconnected from reality that they still believe things like:

The housing bubble and financial crisis are the product of free markets, despite the presence of all sorts of government pro-housing policies like Fannie Mae, Freddie Mac, Clinton's National Homeownership Strategy, Bush's American Dream Downpayment Act, all sorts of similar policies on the state and local level, the ratings agencies given a monopoly by SC policy of requiring investment banks to use them but only certifying three, and the Federal Reserve's interest rate and monetary policy pumping about two trillion dollars into the economy between 2002 and 2006.

That Herbert Hoover's laissez-faire policies caused the Great Depression, despite evidence in Hoover's own writings that he did not believe in laissez-faire, all of his public works projects (ever hear of Hoover Dam?), his strongarming businesses into keeping wages high at precisely the time free market economists say wages should have been allowed to fall to avoid mass unemployment, and evidence that the Fed's stupid monetary policy triggered the boom and bust that started it, resulting in monetary inflation then deflation, which is the reason why wages had to fall.

That California's electric utilities were deregulated, leading to the electricity crisis and rolling blackouts, despite the fact that the so-called deregulation forced businesses that owned both generators and distribution grids to sell off one or the other, and forced those now only owning the grids to buy electricity from generators on an artificial, government created spot market which was heavily regulated, with all sorts of complex rules. See the history of one of those Star Wars names schemes Enron was infamous for, Death Star. All this in an industry that was already throttled by massive environmentalist regulation, and most importantly THERE WERE PRICE CONTROLS! Price controls are the very thing the free market economists say will cause shortages, and that is what a rolling blackout is, a shortage of electricity.

The housing bubble and financial crisis are the product of free markets, despite the presence of all sorts of government pro-housing policies like Fannie Mae, Freddie Mac, Clinton's National Homeownership Strategy, Bush's American Dream Downpayment Act, all sorts of similar policies on the state and local level, the ratings agencies given a monopoly by SC policy of requiring investment banks to use them but only certifying three, and the Federal Reserve's interest rate and monetary policy pumping about two trillion dollars into the economy between 2002 and 2006.

That Herbert Hoover's laissez-faire policies caused the Great Depression, despite evidence in Hoover's own writings that he did not believe in laissez-faire, all of his public works projects (ever hear of Hoover Dam?), his strongarming businesses into keeping wages high at precisely the time free market economists say wages should have been allowed to fall to avoid mass unemployment, and evidence that the Fed's stupid monetary policy triggered the boom and bust that started it, resulting in monetary inflation then deflation, which is the reason why wages had to fall.

That California's electric utilities were deregulated, leading to the electricity crisis and rolling blackouts, despite the fact that the so-called deregulation forced businesses that owned both generators and distribution grids to sell off one or the other, and forced those now only owning the grids to buy electricity from generators on an artificial, government created spot market which was heavily regulated, with all sorts of complex rules. See the history of one of those Star Wars names schemes Enron was infamous for, Death Star. All this in an industry that was already throttled by massive environmentalist regulation, and most importantly THERE WERE PRICE CONTROLS! Price controls are the very thing the free market economists say will cause shortages, and that is what a rolling blackout is, a shortage of electricity.

I can't blame them for not reading such a thick book when Mao's Little Red book is so much smaller and cuter.

I read most of Ayn Rand's books many years ago but I am in the same mind as Rossini after hearing a Wagner opera:

“One can't judge Wagner's opera Lohengrin after a first hearing, and I certainly don't intend to hear it a second time”

I do remember liking "We the Living" however.

-- Modified on 2/24/2011 4:50:49 PM

-- Modified on 2/24/2011 4:51:26 PM

a right wing bitch tuned "stoolie" during the shameful Mccarthy withchunt period.

Btw, if you're such a proud Rand supporter, why the chickenshit alias ? What are YOU afraid of ?!-----LMAO!

The great depression, my cowardly friend, was caused by a wildly unregulated Wall St ( wow---parallel to today ) where people could buy stock on "margin", with just a 10% payment,that ultimately led to the collapse of the stock market. The economy was flawed in many other ways, notably the highly restrictive Hawley-Smoot tariff ,which dried up international trade with the U.S. in the early 30's.

However, just keep ignoring the facts in your lobotomized fashion & keep drinking that "right-wing kool-aid". I'm now expecting you to fly out to Wisconsin to union bust.-----![]()

However, if things don't work out for you, I expect you to "switch cults", & see you promoting Scientology on Hollywood blvd.-----LMAO !

Fascinating, though predictable, how almost your entire post consists of ad hominem attacks, slurs, insults, just a lot of snarling rhetoric. Why all the hate?

Given the nature of this forum and website, isn't EVERYONE using an alias? I chose one appropriate to the subject I want to talk about and my particular position on the issues.

As to Wall Street being unregulated, that doesn't make a free market. The problem was central banking pumping massive amounts of new money into the economy. A free market does regulate itself, and that is what would have happened without monetary inflation throughout the 1920's. Economists point to a stable CPI through most of the 20's as evidence that there was no inflation. But given that that decade exhibited massive increases in productivity of labor and an increase in the supply of goods, this stable CPI means there was monetary inflation. Larger and large supplies of money were being used to buy larger and larger supplies of goods. To keep the money supply on par with the increased supply of goods, the Fed and the treasury has to print more and more money. Wall Street traders are often among the earliest people to get this new money. This causes injection effects, market distortions that unbalance the economy, creating an unsustainable boom. It was when the Fed lowered interest rates to help England out with its monetary blunders that the boom really took off.

I suggest you learn a thing or two about the Austrian theory of the Business Cycle. Wall Street traders did participate in the economic boom that led to the bust, but they were responding to the perverse incentives of inflation.

literary criticism or economic history, so don't be offended by his ad hominem attacks.

When we say that the United States has a free market, I don't think anyone intends for that to be taken literally. Wall Street is in fact and has always been regulated directly by both the state and the federal government and indirectly by civil lawsuits. There was regulation even before the great Depression; the difference is the extent.

I don't quite follow your point about Wall Street traders being "among the first to get this new money." If you are talking about the change in access policy for the Fed's Discount Window during the financial crisis, many financial institutions benefited from that policy, not just institutions with a trading desk.

I said "among the earliest". Long before that money gets into the hands of consumers to cause CPI inflation, it is used for all sorts of investment, bailouts, government grants and subsidies, and anything else that requires large loans. It changes hands probably many times. One estimate I have seen is that it takes new money created by the treasury and the Fed 36 months to show up as consumer price inflation. Wall Street gets to play with it plenty before then. That is why it causes so much distortion of markets, causing the malinvestment that is a critical part of the Austrian Theory of the Business Cycle.

-- Modified on 2/24/2011 3:45:57 PM

People didn't buy stocks then on 10% margins ?!

The stock market in '29 wasn't a victim of unregulated laissez faire capitalism ? There was regulation before then ? Keep in mind that the SEC wasn't created until 1934.

You may be better at chomping on Baklavas than literary criticism, since Rand is regarded as a right wing hack by many.

You ain't so hot on U.S. economic history either;

stick to "whitewashing" Iranian history for the last 32 years--------![]()

Yes, people bought stocks on margin. They were encouraged to do so by the additional currency at low interest rates provided by the Federal Reserve.

We did not have unregulated laissez-faire capitalism in '29. We never had it at all, though it was closer before the Federal Reserve was founded. Didn't you read where I explained that it was the Fed that caused the stock market bubble and subsequent crash? And even before then, Hoover was monkeying with the economy in other ways. Ever hear of the Agricultural Marketing Act of 1929?

From the link I am now posting:

A partial list of interventions — those government economic regulations — would include:

* Bureau of Corporations (1903)

* Interstate Commerce Act major amendments (1903, 1906, 1910)

* Meat Inspection Act (1906)

* Pure Food and Drug Act (1906)

* Corporation Tax (1911)

* Sixteenth Amendment to the Constitution (1913) (Income Tax)

* Federal Reserve System (1913)

* Clayton Antitrust Act (1914)

* Federal Trade Commission (1914)

* U.S. Immigration (cut to a trickle during 1915—1920)

* Adamson Act (1916) (railroad labor wage rates)

* Shipping Act (1916)

* National Defense Act (1916)

* Army Appropriations Act (1916) (later took over railroads)

* Selective Service Act (1917)

* Espionage Act (1917)

* Lever Act (1917) (food and fuel) (prohibited alcohol)

* Overman Act (1918) (executive powers)

* War Finance Corporation Act (1918)

* President's Mediation Commission (1917) (labor relations)

* Federal Control Act (1918)

* Sedition Act (1918)

Does this look like a laissez-faire list?

Higgs summarizes just exactly how guided and regulated all economic activities were:

The two years, 1916—1918, witnessed an enormous and wholly unprecedented intervention of the federal government in the nation's economic affairs. By the time of the armistice, the government had taken over the ocean shipping, railroad, telephone, and telegraph industries; commandeered hundreds of manufacturing plants; entered into massive economic enterprises on its own account in such varied departments as shipbuilding, wheat trading, and building construction; undertaken to lend huge sums to businesses directly or indirectly and to regulate the private issuance of securities; established official priorities for the use of transportation facilities, food, fuel, and many raw materials; fixed the prices of dozens of important commodities; intervened in hundreds of labor disputes; and conscripted millions of men for service in the armed forces. It had, in short, extensively distorted or wholly displaced markets, creating what some contemporaries called war socialism.

-- Modified on 2/24/2011 5:11:55 PM

was surprised at the extent of the pre-1929 regulation (and I believe that is just federal) offered by MrLassezFaire.

This gentleman is clearly an expert in this area; plus unlike you, he has actually read Atlas Shrugged.

I think we should both thank him for the education.

Part of the Laissez Faire economy of the 20's.

Btw,I havent read "The Turner Diaries" or "Dianetics" either---------------![]()

-- Modified on 2/24/2011 7:01:50 PM

position of "wildly unregulated" to "inefficient regulation," which is what Mr. LF and I were trying to explain to you.

Now, while you are at it, why not apologize to Quad and Jolene for your lack of awareness as to how to spell "frieking."

which is the same as "wildly unregulated"

I don't apologize for lamebrained Sophistry, whether it comes from "cultish sheep", adherents of

a moronic dictionary, or one who claims the current Iranian government is " Democratic"----

-- Modified on 2/24/2011 7:15:21 PM

Actually, you are right that government regulation of markets, which is ALWAYS inefficient, is the same as no regulation. The only way something as complex as a market can be properly regulated is self-regulation. A free market has certain checks and balances which prevent things like massive bubbles and monetary recessions. If we had a gold standard without a central bank, the limits of the money supply would prevent the kind of wild speculation on the stock market like we had in the late 1920's. It is only when the government steps in to try to regulate that these self-regulating mechanisms fail.

This is what we saw in this recent housing bubble. Normally, banks are very careful who they lend money to, making sure home buyers can make a good down payment, have collateral, and a steady source of income. But we had Fannie and Freddie buying up home loans, relieving banks of the need to make sure borrowers could pay the money back. We had "ratings agencies" which were given a regulatory function by the SEC, which gave them a monopoly by only certifying three of them. Everyone knows what happens to the quality of a product under a monopoly. There were a whole lot more regulations and government programs encouraging home ownership, and on top of it all, the Fed with its funds rate at 1% for a couple years pumping about two trillion dollars into the economy, setting off a speculative bubble.

How do you expect the natural self-regulating processes of a market to work in such conditions?

...then perhaps we ought to consider if that means that government is superior to markets.

If markets only function with zero referees on the field, then maybe we ought to replace it with something that isn't so problematic.

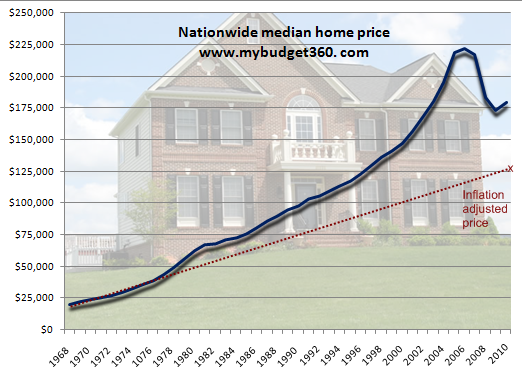

Here's a historical graph of home values in the USA.

http://www.ballina.info/real-estate/news/wp-content/uploads/2007/04/homevalues1.gif' target=_blank class=green>http://web.archive.org/web/20070831163959/http://www.ballina.info/real-estate/news/wp-content/uploads/2007/04/homevalues1.gif

Take note that at the end of 1999 marked the deregulation of Glass Steagal.

Your links aren't working.

Try using the link form at the bottom of the page.

The rise in home values also came after Clinton's National Homeownership Strategy. The timing seems to fit better to me, because it takes time for such policies to take effect. Glass Steagal is repealed, and suddenly, boom! Housing prices rise? It takes time to reorganize banks and start shifting money around.

Besides, I can find plenty of graphs that seem to contradict yours.

Here's another one that indicates the bubble started even earlier, four years before Glass Steagal was abolished, then really took off when the Fed dropped its funds rate to 1%.

Its government that is problematic. Markets are the means by which consumers signal their preferences for goods and services to producers. There IS NO OTHER WAY TO DO IT! Prices are an honest quantitative assessment of how people value goods and services, how badly they want and need them in respect to the availability of the resources needed to produce them.

Any other system tends to impose the values of a few rulers on the rest of society. If you replace market prices with voting, things get even worse. People vote for what they feel they want, out of context to the availability of resources.

There is no other way to coordinate the vast amount of information that needs to be taken into acocount in the productive process.

Try reading "I, Pencil" by Leanard Reed

"Its government that is problematic. Markets are the means by which consumers signal their preferences for goods and services to producers."

Except that consumers can only engage in a reactionary fashion rather than a proactive one. Consumers can select from what is already produced, but they don't have any input on what should be produced. This gets even more problematic, once you look into how advertising is nothing more than propaganda to sell products. Toy companies are hiring child psychologists to teach kids how to nag their parents more effectively.

"There IS NO OTHER WAY TO DO IT!"

Sure there is. I already showed you a link to the Mondragon collectives. There are already people who have tried Michael Albert's PARECON model, albeit at the micro scale.

"Any other system tends to impose the values of a few rulers on the rest of society."

Markets impose not just values, but actual rulers. The Koch brothers for instance. Or George Soros. Or anyone with a lot of money.

PARECON, on the other hand is completely leaderless. It is literally impossible to impose any value on anyone.

"If you replace market prices with voting, things get even worse. People vote for what they feel they want, out of context to the availability of resources."

I think you ought to study the PARECON model a bit more.

"There is no other way to coordinate the vast amount of information that needs to be taken into acocount in the productive process."

I know Mises fans don't like to hear this, but a large amount of that information doesn't need to be factored in, for the same reason that Uncle Sam doesn't care if I don't calculate my income within a billionth of a cent when I file my taxes.

And another graph that shows the bubble starting long before 1999.

-- Modified on 2/25/2011 5:03:26 PM

And another

the link didn't post right, since I had to use the way back machine. Here you go.

OK. worked that time.

Now that I can see it, I'll say that I've seen it before. It shows the home values beginning their rocket like climb, not in 1999 with the repeal of Glass-Steagal, but in 1997, two years before. Makes a problem for your post hoc ergo propter hoc argument.

Is that another "oops"?

-- Modified on 2/26/2011 5:33:41 AM

There never seems to be enough regulation. Those who want regulation keep piling on more and more and more, and when the inevitable unintended consequences rear their ugly heads, people like Priapus, who seem to want a total dictatorship, cry that there wasn't enough!

As I said, the wild speculation on the stock market in the late 20's was caused by the Federal Reserve pumping too much money into the economy, causing the initial rise in prices and providing investors with the liquidity to keep bidding the prices up. No amount of regulation would have prevented the bubble, short of total government control. And history shows us what communism accomplishes.

Even Ben Bernanke admitted that the Fed caused the Great Depression. He promised not to do it again, then promptly did it again!

"Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again." -- Ben Bernanke

The only real, permanent solution is to end the Fed. Or they will keep doing it again. They are doing it again right now!

of course this sort of delusional thinking is prevalent on the far right, evidence of which can be found below.

I will give you some minor credit for casting off

your chickenshit alias, tho.-------![]()

However, you can piss in the wind all you want with your radical libertarianism---what you propose will NEVER happen--your drastic cutbacks of government regulations ( & government , for that matter ) will NEVER come to pass, because too many people rely on them.

So keep screaming your "Rand cult jeremiads" from your bunker---no one is listening & they will NEVER be implemented.

-- Modified on 2/25/2011 5:57:17 AM

So if you do not want total dictatorship, can you please explain how much regulation is enough for you? Because nothing ever seems to be enough, or the right kind. Seems to me like you will not be satisfied till nobody will be allowed to make a move without asking the government for permission.

It may be that laissez-faire will never be truly implemented. But if that is true, then we will never achieve anything resembling economic stability, and we will constantly be going through these boom-bust cycles, throwing vast numbers of people back into poverty. And as liberal talking heads keep blaming the downturns on free markets, the danger will continue to grow that we will fall into more and more of a dictatorship. More regulation will cause more problems which will justify more regulation, in a vicious circle which F A Hayek describes as "The Road to Serfdom".

Of course, this course can be changed, if enough people learn the truth, shaking off this "laissez-faire caused the Great Depression" propaganda.

And the only thing really keeping us from free markets is the silly propaganda that free markets supposedly caused the Great Depression. Stupid or power hungry liberals keep that myth alive, along with the other two I mentioned, and a vast number of others. They control the universities, they publish the text books, indoctrinate students at all levels.

I remember learning in high school that laissez-faire was abandoned because the Great Depression proved that it didn't work. It wasn't till I started learning about Austrian Economics that I learned that laissez-faire had ABSOLUTELY NOTHING TO DO WITH THE GREAT DEPRESSION!

Read Murray Rothbard's "America's Great Depression". He explains the role of "Hoover's New Deal". He argues that Hoover implemented almost every measure that FDR did years later.

As Rothbard writes:

Laissez-faire, then, was the policy dictated both by sound theory and by historical precedent. But in 1929, the sound course was rudely brushed aside. Led by President Hoover, the government embarked on what Anderson has accurately called the “Hoover New Deal.” For if we define “New Deal” as an antidepression program marked by extensive governmental economic planning and intervention—including bolstering of wage rates and prices, expansion of credit, propping up of weak firms, and increased government

spending (e.g., subsidies to unemployment and public works)—Herbert Clark Hoover must be considered the founder of the New Deal in America. Hoover, from the very start of the depression, set his course unerringly toward the violation of all the laissez-faire canons. As a consequence, he left office with the economy at the depths of an unprecedented depression, with no recovery in sight after three and a half years, and with unemployment at the terrible and unprecedented rate of 25 percent of the labor force.

Hoover’s role as founder of a revolutionary program of government planning to combat depression has been unjustly neglected by historians. Franklin D. Roosevelt, in large part, merely elaborated the policies laid down by his predecessor.

While it can be used to give favor to a particular business when businesses bribe government, it can also be used to make it harder for businesses to function generally. This is a good thing. It makes businesses stronger and work harder for their money. They're less prone to risk taking in such an environment.

If the wild speculation in the stock market of the 1920's was caused by the fed pumping too much money into the economy, then WHY did the Fed pump too much money into the economy? Just to be nasty shits?

The reality is that the assembly line saw productivity skyrocket. Labor unions had been destroyed or severely hurt. This kept wages low. Factory work saw wage to productivity ratios of 1:4, which is about what we see today in the fast food industry. Workers were broke, and needed something to maintain their standard of living. THAT was the incentive for the Fed to pump more money into the economy, with the modern creation of credit for average people.

Bernanke admitting the Fed broke the economy is like a pig admitting that he rolls in his own shit. The guy is a Milton Friedman fan for Christ's sake.

Strangely enough, the Fed was created in 1913, which preceeded the creation of the modern American middle class. It predated the United States becoming the strongest economy the world had ever seen. Now, I'm not suggesting a causal link here, but we do understand linear time, do we not?

So you are saying that inflation, producing higher consumer good prices, is good for workers????

Higher prices are good????

And you guys keep saying I'm the crazy one.

I've said this before on this board, but I'll repeat it.

Inflation is the value of a currency declining. If you have a lot of savings, then your savings lose value. If you have a lot of debt, then your debt loses value.

Deflation is the value of currency increasing. If you have a lot of savings, then your savings grow in value. If you have a lot of debt, then you debt increases in value.

So if you're rich, you hate inflation, which is why the Mises fans hate inflation so much. If you're poor and up to your neck in debt, then inflation is very good for you. The inverse is also true for deflation. If you're rich, you love deflation (which is why Mises fans like a gold backed dollar, because the economy would grow while the currency does not), further enriching the wealthy. If you're poor, and you have a lot of debt, then deflation will keep the value of your debts increasing, putting you into a cycle of debt slavery. Which also pleases the Mises fans.

Take note that we now have record government, corporate, and (most especially) household debt. Household debt has increased by OVER 1000% since 1980. Yes, that's with three zeros.

The down side to inflation is that it decreases buying power. However, if inflation is slow and steady, problems with it can be off set by raising wages to offset that loss.

"So if you're rich, you hate inflation, which is why the Mises fans hate inflation so much."

Very Marxist of you. Its seems he was the one who made it respectable to make ad hominem arguments by claiming that opponents of his drivel had some class interest in opposing his pseudo-economics.

Lots of rich people were up to their necks in debt. As I recall, thats the reason many of them jumped out of windows in 1929.

Inflation ENCOURAGED people to take on debts they cannot afford. That is THE reason so many people are underwater with their mortgages.

And inflation always leads to deflation. ALWAYS. Partly because it first leads to hyperinflation. People adapt to the low level of inflation, so it loses it effects, requiring your central bank to increase the inflation rate to keep things going. And once people, including businesses, borrowers, and lenders, adapt to the newer high interest rates, it stops having its positive benefits, again, requiring another increase in the inflation rate. Eventually, to avoid hyperinflation, the central bank has to cut off the flow, people lose confidence, and you get the deflation. Every time.

Your support for inflation makes the deflation necessary and inevitable.

"But, and this brings me to my next point, "full employment" in his sense requires not only continued inflation but inflation at a growing rate. Because, as we have seen, it will have its immediate beneficial effect only so long as it, or at least its magnitude, is not foreseen. But once it has continued for some time, its further continuance comes to be expected. If prices have for some time been rising at five percent per annum, it comes to be expected that they will do the same in the future. Present prices of factors are driven up by the expectation of the higher prices for the product--sometimes, where some of the cost elements are fixed, the flexible costs may be driven up even more than the expected rise of the price of the product--up to the point where there will be only a normal profit.

"But if prices then do not rise more than expected, no extra profits will be made. Although prices continue to rise at the former rate, this will no longer have the miraculous effect on sales and employment it had before. The artificial gains will disappear, there will again be losses, and some firms will find that prices will not even cover costs. To maintain the effect inflation had earlier when its full extent was not anticipated, it will have to be stronger than before."--F.A. Hayek

Near the end of your post, you use the same kind of ad hominem as before, claiming that Austrian economists want people to be forever in debt. THIS IS A LIE. Bankruptcy is a bad thing, but Austrians argue for its use because it clears bad debt out of the economy, breaking this "debt slavery" you seem to think pleases Austrians.

As is quit typical of the critics of free market economics, you claim someone believes the exact opposite of what they say in order to make fallacious arguments against them because you are unable to meet their ideas head on.

Marx would be proud.

-- Modified on 2/26/2011 5:34:09 AM

Board Admin

"Here are NINE very acceptable reasons for the use of an alias.

1.Use of topical humor when the alias enhances the humor

2.The creation of a character(literary license) to be used in an informative, fun, innocuously sarcastic, philanthropic, as well as topical way.

3.Anonymity for when regional or associational sensitivities may be of concern, particularly when there are members out there who will harass you on the boards when you disagree strongly with them.

4.Innocuous playing of "devils advocate" in a discussion or debate where one wishes to not be further/future aligned with one faction or the other. If you look at the GD Board, there are providers who have flat out stated that they won't see someone based on some of their posts. Why would any guy take the chance.

5.Avoidance of suffering political fallout for a comment that may have been wrongly construed in a possibly volatile discussion. Some of these regular posters are hyper-sensitive, and also don't read the whole post before going ballistic.

6.Posting investigative reports, meet & greet announcements, helpful advice, or other similar types of useful information where the use of a user-name could prove problematic or open the poster up to incessant PM's and questions.

7.Concerns in revealing your review history. This is a big one when you are posting about a particular provider that you are not going to name. In those situations, you open ALL of your reviewed providers to the public guessing who you are talking about. It's not fair to the others.

8.Ability to contribute where you would otherwise feel embarrassed to speak candidly. Some are just too shy, but will post under an alias.

9.To avoid a google search turning up your review history. Some of these guys only post in alias for this reason"

...if you accept that corporations are creations of the state, and must therefore be ABOLISHED. Unfortunately, I have never met an Ayn Rand fan, who really believed this.

1) a truely free market could not be created without resorting to a kind of Primitivism.

2) markets rely on government for an endless number of things, including a stable currency to act as a medium to conduct business, as well as the courts to enforce contracts.

However, we can chart likely outcomes via extrapolation.

When markets became more heavily regulated (the most regulated in our history) from the 50's to the 70's, we didn't have these frequent boom and bust cycles.

When our economy, as a modern capitalist economy, was the least regulated, from the 1870's to the 1920's, you had the longest deflationary recession in US history, and the makings for the worse recession in US history. Not to mention child labor, company stores, workers being required to force their wives to help them with their work, no compensation for injury on the job, etc.

Faith in market self-correction are not sufficient to self-corrections to happen. I think the evidence bares that out. Furthermore, as the People are the Sovereigns, the purpose of any institution is for it to serve the people, not the only way around.

If making rules on how markets work makes them dysfunctional, then maybe we ought to consider markets themselves as dysfunctional, and replace it with a new economic medium, laying it's foundation on such principles that it should shall seem most likely to effect the Safety, Well-Being, and Happiness of everyone.

-- Modified on 2/24/2011 7:41:59 AM

Much of your post is difficult to follow. Your sentence structure needs work.

However, I can answer some of your points:

There are some problems with our corporate law as it is, but a corporation can be a voluntary association of individuals. I'm not so sure about the idea of treating a corporation as an individual, like a person. This is an issue I have not studied enough, but it has little bearing on the issues I named, that these instances where free markets are blamed for economic disasters did not involve free markets.

Government does NOT provide us with a stable currency. It provides us with inflation, fiat money, central banks manipulating interest rates, and market distortions. A free banking system, with banks free to coin their own money, would be a free banking system, and it has been argued would provide us with a much more stable currency.

The 1870's to early 1900's saw CPI deflation, but that was not a recession. It was a time of low unemployment and steady economic growth. Consumer goods and commodity prices did tend to fall, but that was because the productivity of the economy was increasing, lowering production costs along with prices. Businesses were still able to make profits because they were reducing production costs, which allowed them to reduce prices to the consumer. This is a sign of a very healthy economy, not a recession.

The 50's to the 70's had relatively stable economic growth because of the Brenton Woods agreement which gave us one of the most important foundations of a free market, a gold standard.

Child labor was not abolished by laws, but by improvements in productivity, which provided us with the prosperity that allowed us to send our children to school instead of work. Politicians who wrote and passed child labor laws were, as some have put it, jumping in front of a parade already going down the street, in order to pretend to be leading it. For evidence, have a look at poor nations which impose child labor laws. Those laws become unenforceable because the children need to work simply to put food on the table. Do a Google search for "The Children of the Black Dust" in Bangladesh.

As for finding some other means of organizing economies other than markets, nothing has been proven to work better than markets. Everything else has resulted in ruin, mass poverty, famine, and oppression.

For the reason why, I suggest reading Ludwig Von Mises' "Socialism". Or look up any good reference on economic coordination, monetary calculation and markets. No other means can coordinate consumption with production and the use of resources. Other means have been tried, and failed miserably.

But that doesn't keep the faithful from trying.

"Overproduction" is a discredited Keynesian doctrine. It is absurd on the face of it, implying that we can become poor by becoming too rich. What does happen during the boom phase of the cycle is that producers are misled into producing too many of the wrong goods (such as new housing in the most recent) at the expense of goods people would have demanded more of had there been no market distorting inflation. Then there is deflation, and consumers re-assert their actual preferences, many people lose their jobs because there is less money going around, so retailers who stocked up on the wrong goods find they have surpluses they cannot sell.

-- Modified on 2/24/2011 1:50:19 PM

BTW, free market economists do believe government is needed for, among other things, enforcing contracts as you said. Government violates the freedom of markets when it goes beyond the function of protecting property rights to telling people what to do with their property. Enforcing contracts is a form of property rights protection. If someone has a contract to have certain goods delivered to them, those goods are rightfully their property.

Just more evidence that the loudest, most hysterical critics of free market ideas have no clue what they are criticizing.

-- Modified on 2/24/2011 4:06:32 PM

"Much of your post is difficult to follow. Your sentence structure needs work."

Most people can read past typos. Well, I hope I'm not being presumptuous about that.

"I'm not so sure about the idea of treating a corporation as an individual, like a person. This is an issue I have not studied enough, but it has little bearing on the issues I named, that these instances where free markets are blamed for economic disasters did not involve free markets."

So, would this mean that if I can link corporate personhood as a major contributing factor in an economic disaster, you'd have to retract your argument?

The deregulation of the Glass Steagal Act is often cited by many economists as the foundational cause of the housing bubble. I'm not going to argue that, since it's not in line with the Mises Institute, or the Rothbard fans. However, you cannot deny that without the passage of the Gramm–Leach–Bliley Act, CitiGroup would not exist. And if CitiGroup didn't exist, they would not have been bailed out. And I know that free marketeers frequently call that bail out a disaster.

I think you would also agree that the Gramm–Leach–Bliley Act would not have likely been passed if banking interests hadn't given Phil Gramm a lot of campaign dollars. After all, the guy is currently employed by UBS.

Banking interests were able to bribe Phil Gramm, because it was decided by the Supreme Court in Buckley v. Valeo that for a corporation's money was free speech. Why would would a corporation have the right to free speech? Because that same Supreme Court decided that corporations had the right to personhood.

How's that for a game of Kevin Bacon?

"Government does NOT provide us with a stable currency."

I like to reply to things with links.

http://en.wikipedia.org/wiki/Full_Faith_and_Credit_Clause

"It provides us with inflation"

Inflation more often than not occurs due to our fractional reserve banking system, at the micro level.

"fiat money"

We actually have an oil-backed dollar.

"central banks manipulating interest rates"

That's a good thing.

"and market distortions."

Markets distort themselves.

"A free banking system, with banks free to coin their own money, would be a free banking system, and it has been argued would provide us with a much more stable currency."

How would multiple currencies all competing against each other create stability?

"The 1870's to early 1900's saw CPI deflation, but that was not a recession."

Unless you asked your average American farmer.

"It was a time of low unemployment and steady economic growth."

It's true that a lot of children were employed. But steady economic growth? Again, I like to reply with links.

http://en.wikipedia.org/wiki/Long_Depression

"This is a sign of a very healthy economy, not a recession."

You call it a healthy economy, I call it the longest DEpression in US history. But potato/potatoe, right?

"Child labor was not abolished by laws, but by improvements in productivity, which provided us with the prosperity that allowed us to send our children to school instead of work."

Some data to back this up would be appreciated.

"Those laws become unenforceable because the children need to work simply to put food on the table."

Is any law easily enforceable in a third world country?

"As for finding some other means of organizing economies other than markets, nothing has been proven to work better than markets. Everything else has resulted in ruin, mass poverty, famine, and oppression."

Not everything.

http://en.wikipedia.org/wiki/Mondragon_Corporation

"For the reason why, I suggest reading Ludwig Von Mises' "Socialism"."

I'm familiar.

"No other means can coordinate consumption with production and the use of resources. Other means have been tried, and failed miserably."

Except markets don't particularly coordinate well with consumption with production with given resources. If they did, then we wouldn't be in the middle of a resource war for oil while the sun provides us with something in the magnitude of 10,000 times more energy then we consume world wide.

"Overproduction" is a discredited Keynesian doctrine. It is absurd on the face of it, implying that we can become poor by becoming too rich."

I'm sure a lot of Americans who now have negative home equity will be quite please by their riches.

Let's try this exercise and see where it goes.

Supply = Demand.

therefore,

Supply + X must equal Demand + X

Therefore, stimulating supply (production) must equal a proportional stimulation to demand (wages).

If that doesn't happen, then there either must be a market correction (overproduction) or create an incentive to shore up demand (create cheap credit to replace wages). Eventually the debt bill comes due, and crash goes the economy. (Overproduction)

This should be familiar, because this is basically the Mises explanation for market cycles. They just like to blame the Fed for causing this mess (leaving out that we had economic crashes before there was a Fed, like the longest DEpression in US history), when they should be looking at the root cause in wages not raising at the same rate as productivity gains.

"BTW, free market economists do believe government is needed for, among other things, enforcing contracts as you said."

Not if you talk to anarcho-capitalists.

"Government violates the freedom of markets"

Markets are an institution. Institutions only have freedoms that the People have given them.

"Just more evidence that the loudest, most hysterical critics of free market ideas have no clue what they are criticizing."

You got me there.

-- Modified on 2/24/2011 11:36:56 PM

I don't have much time right now to reply to everything you said, but I'll let Murray Rothbard answer you about the Long Depression:

From "History of Money and Banking in the United States" by Murray Rothbard

Orthodox economic historians have long complained about the “great depression” that is supposed to have struck the United States in the panic of 1873 and lasted for an unprecedented six years, until 1879. Much of this stagnation is supposed to have been caused by a monetary contraction leading to the resumption of specie payments in 1879. Yet what sort of “depression” is it which saw an extraordinarily large expansion of industry, of railroads, of physical output, of net national product, or real per capita income? As Friedman and Schwartz admit, the decade from 1869 to 1879 saw a 3-percent-perannum increase in money national product, an outstanding real national product growth of 6.8 percent per year in this period, and a phenomenal rise of 4.5 percent per year in real product per capita. Even the alleged “monetary contraction” never took place, the money supply increasing by 2.7 percent per year in this period. From 1873 through 1878, before another spurt of monetary expansion, the total supply of bank money rose from $1.964 billion to $2.221 billion—a rise of 13.1 percent or 2.6 percent per year. In short, a modest but definite rise, and scarcely a contraction. It should be clear, then, that the “great depression” of the 1870s is merely a myth—a myth brought about by misinterpretation of the fact that prices in general fell sharply during the entire period. Indeed they fell from the end of the Civil War until 1879. Friedman and Schwartz estimated that prices in general fell from 1869 to 1879 by 3.8 percent per annum. Unfortunately, most historians and economists are conditioned to believe that steadily and sharply falling prices must result in depression: hence their amazement at the obvious prosperity and economic growth during this era. For they have overlooked the fact that in the natural course of events, when government and the banking system do not increase the money supply very rapidly, freemarket capitalism will result in an increase of production and economic growth so great as to swamp the increase of money supply. Prices will fall, and the consequences will be not depression or stagnation, but prosperity (since costs are falling, too) economic growth, and the spread of the increased living standard to all the consumers.

Yes, the Long Depression was indeed a great time of prosperity, especially for banks. Of course, we can ignore all those Populist uprisings at the time as meaningless. ![]()

The Long Depression was from 1873 to 1896. Now you are talking about a depression that started in 1893. Is this what they call a bait and switch?

Mises Wiki has a nice description of that panic. More government intervention and regulation of the currency system:

Fears about the American gold standard were intensified in March 1891, when the Treasury suddenly imposed a stiff fee on the export of gold bars taken from its vaults so that most gold exported from then on was American gold coin rather than bars. A shock went through the financial community, in the U.S. and abroad, when the United States Senate passed a free-silver coinage bill in July 1892; the fact that the bill went no further was not enough to restore confidence in the gold standard. Banks began to insert clauses in loans and mortgages requiring payment in gold coin; clearly the dollar was no longer trusted. Gold exports intensified in 1892, the Treasury’s gold reserve declined, and a run ensued on the U.S. Treasury. In February 1893, the Treasury persuaded New York banks, which had drawn down $6 million on gold from the Treasury by presenting Treasury notes for redemption, to return the gold and reacquire the paper. This act of desperation was scarcely calculated to restore confidence in the paper dollar. The Treasury was paying the price for specie resumption without bothering to contract the paper notes in circulation. The gold standard was therefore inherently shaky, resting only on public confidence, and that was giving way under the silver agitation and under desperate acts by the Treasury.

-- Modified on 2/25/2011 9:11:57 PM

I'll admit right here and now that my understanding of money matters if far less than I'd like, but I do enjoy learning. Most of those in the 1800s didn't stem from regulations, did they?

For a good answer to that , read George Selgin's "Central Banks as Sources of Financial Instability". There were other government sponsored banks before the Federal Reserve which had the same powers, but were not charged with the job of trying to stabilize the money supply and the whole economy. It was only after they had CAUSED such instability that someone got the bright idea of having them stabilize the economy, without admitting that they caused the instability in the first place.

George Selgin explains that easily. Central banks are simply the most common way governments distort the money supply and price structure. But governments have other means to accomplish the same thing.

He writes:

However, financial crises have not been limited to those nations in which currency-issuing privileges are concentrated in a single bank. The United States, in particular, endured a series of severe crises—in 1873, 1884, 1893, and 1907—prior to its decision to embrace central banking in the form of the Federal Reserve System, which was created in 1913. The U.S. case therefore appears to contradict my claim that

central banks are properly regarded as destabilizing rather than stabilizing institutions.

The contradiction, however, is more apparent than real. First, by almost any measure, the major financial crises of the Federal Reserve era—those of 1920–21, 1929–33, 1937–38, 1980–82, and 2007–2009 most recently—have been more rather than less severe than those experienced between the Civil War and World War I, even overlooking outbreaks of relatively severe inflation from 1917 to 1920 and from 1973 to 1980. More important, the pre-Fed crises can themselves be shown to have been exacerbated, if not caused, by regulations originally aimed at easing the Union government’s fiscal burden. The U.S. case therefore represents a special instance of the general pattern according to which central banking emerged as an unintended by-product of fiscally motivated government interference with the free development of national financial institutions.

The interference in the U.S. case consisted, in part, of Civil War legislation that limited commercial banks’ ability to issue their own banknotes.5 National banks were allowed to issue their own notes only if every dollar of such notes was backed by $1.10 in federal government bonds, and state-chartered banks were forced to withdraw altogether from the currency business by a prohibitive tax assessed against their

outstanding circulation beginning in August 1866. The result of these combined regulations was an aggregate stock of paper currency geared to the available supply of government securities. From the late 1870s onward, as the government took advantage of regular budget surpluses to reduce its outstanding debt, the supply of eligible backing for national banknotes dwindled, and the total stock of such notes

also dwindled until, by 1891, the latter stock was only half as great in value terms as it had been a decade earlier. Regulations also prevented the stock of currency from adjusting along with seasonal increases in currency demand. Yet the U.S. economy was growing, and the seasonal demand for currency tended to rise sharply during the harvest season—that is, between August and November of each year. In the circumstances, it is hardly surprising that the United States endured frequent crises and that they all involved more or less severe shortages of paper currency.

...that getting rid of the Fed would not solve these problems with economic crashes.

This amazing thing called markets are sounding more fragile and temperamental by the second. If we were talking about cars, then even Toyota would have issued a recall by now.

Of course. What we need is a free market in banking. Instead of a monopoly. I wonder if antitrust laws could help to overturn the Fed?

Actually, markets are VERY robust. It takes a sledgehammer like government to do them any damage. The fact that we have any prosperity at all, especially the growing prosperity we actually enjoy, shows how strong markets are. They simply don't work as well under government regulation as they do when they are free.

All of this actually means that government regulation is blind, stupid, ineffective, counterproductive, damaging, and destabilizing.

You seem to be arguing that since health is so fragile and temperamental, harmed by the merest poison or pathogen, we should give up trying to be healthy at all, and just drink cyanide and sewage and get it over with.

-- Modified on 2/26/2011 6:05:30 AM