but can't go after Al Sharpton for millions he owes, I think the states he has made money in should go after him if the IRS won't.

"Adult entertainer" thought she could avoid reporting "gifts".

"At trial, Fxxx explained that in addition to the money that she earned dancing on stage, she also made money off stage in private rooms at the exotic dancing clubs or off the premises."

"...for money for constructing her home, paying bills, getting breast implants, and paying college tuition... She considered it all a gift. Fxxxx testified that she thanked (folks) for the money gifted her by giving him free private dances."

She was convicted on 4 counts since under-reported income for 4 tax years in U.S. District Court. Sentenced to 33 months on each count but concurrently.

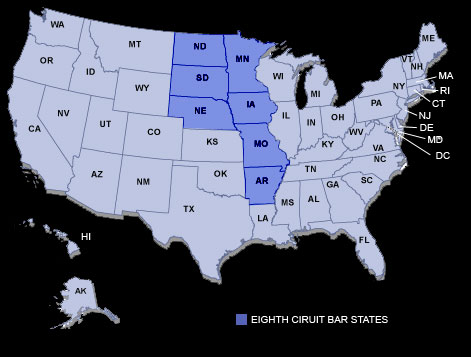

Appealed to the 8th Circuit

"On appeal, Fxxxx argues that (1) insufficient evidence exists to support the jury's finding that Fxxxx knowingly and willfully underreported her income; (2) the district court abused its discretion in failing to instruct the jury that it was required to unanimously agree on which source of income that Fxxxx failed to report on her income tax return; and (3) the district court improperly calculated Fxxx's Guidelines range and imposed a substantively unreasonable sentence."

The jury convicted based on unreported income from individuals, payments for parties and unreported tips at a strip club.

"Fairchild argues that her 33-month sentence is procedurally and substantively unreasonable. First, she asserts that the district court's calculation of the Guidelines range was based on an erroneous calculation of the tax-loss amount and an erroneous finding that Fxxxxx failed to report income from criminal activity. Second, she maintains that her 33-month sentence is substantively unreasonable for failing to account for the effects of past sexual abuse and her status as the sole parent to three young children."

The Defendant's own testimony during the trial indicated that she received tips during the time period in question in cash. She admitted that was not reported as income on her income tax returns, "and she stated that was just an oversight."

The Defendant also objected to the sentence enhancement since the unreported income was over $10,000 a year from illegal income - prostitution.

In a 26 page decision filed 3/17/2016 the 8th Circuit rejected all of her arguments and upheld the 33-month prison term. And of course would have to pay back taxes with large penalties for failure to report.

Source: United States Court of Appeals

For the Eighth Circuit No. 14-3517

Dave notes this reminds me of a fight I had with the IRS decades ago when I was a Tax Supervisor for a then "Big 8" CPA firm. Someone suspected of underreporting income was hit with a $1 million IRS Jeopardy assessment that was a lien on all bank accounts and assets and was outrageous. It took a long time to convince the IRS there was no unreported income and get the lien released.

Sexworker Lost Appeal for False Tax Return - 33 months in prison

"Adult entertainer" thought she could avoid reporting "gifts".

"At trial, Fxxx explained that in addition to the money that she earned dancing on stage, she also made money off stage in private rooms at the exotic dancing clubs or off the premises."

"...for money for constructing her home, paying bills, getting breast implants, and paying college tuition... She considered it all a gift. Fxxxx testified that she thanked (folks) for the money gifted her by giving him free private dances."

She was convicted on 4 counts since under-reported income for 4 tax years in U.S. District Court. Sentenced to 33 months on each count but concurrently.

Appealed to the 8th Circuit

"On appeal, Fxxxx argues that (1) insufficient evidence exists to support the jury's finding that Fxxxx knowingly and willfully underreported her income; (2) the district court abused its discretion in failing to instruct the jury that it was required to unanimously agree on which source of income that Fxxxx failed to report on her income tax return; and (3) the district court improperly calculated Fxxx's Guidelines range and imposed a substantively unreasonable sentence."

The jury convicted based on unreported income from individuals, payments for parties and unreported tips at a strip club.

"Fairchild argues that her 33-month sentence is procedurally and substantively unreasonable. First, she asserts that the district court's calculation of the Guidelines range was based on an erroneous calculation of the tax-loss amount and an erroneous finding that Fxxxxx failed to report income from criminal activity. Second, she maintains that her 33-month sentence is substantively unreasonable for failing to account for the effects of past sexual abuse and her status as the sole parent to three young children."

The Defendant's own testimony during the trial indicated that she received tips during the time period in question in cash. She admitted that was not reported as income on her income tax returns, "and she stated that was just an oversight."

The Defendant also objected to the sentence enhancement since the unreported income was over $10,000 a year from illegal income - prostitution.

In a 26 page decision filed 3/17/2016 the 8th Circuit rejected all of her arguments and upheld the 33-month prison term. And of course would have to pay back taxes with large penalties for failure to report.

Source: United States Court of Appeals

For the Eighth Circuit No. 14-3517

Dave notes this reminds me of a fight I had with the IRS decades ago when I was a Tax Supervisor for a then "Big 8" CPA firm. Someone suspected of underreporting income was hit with a $1 million IRS Jeopardy assessment that was a lien on all bank accounts and assets and was outrageous. It took a long time to convince the IRS there was no unreported income and get the lien released.

but can't go after Al Sharpton for millions he owes, I think the states he has made money in should go after him if the IRS won't.

"Adult entertainer" thought she could avoid reporting "gifts".

"At trial, Fxxx explained that in addition to the money that she earned dancing on stage, she also made money off stage in private rooms at the exotic dancing clubs or off the premises."

"...for money for constructing her home, paying bills, getting breast implants, and paying college tuition... She considered it all a gift. Fxxxx testified that she thanked (folks) for the money gifted her by giving him free private dances."

She was convicted on 4 counts since under-reported income for 4 tax years in U.S. District Court. Sentenced to 33 months on each count but concurrently.

Appealed to the 8th Circuit

"On appeal, Fxxxx argues that (1) insufficient evidence exists to support the jury's finding that Fxxxx knowingly and willfully underreported her income; (2) the district court abused its discretion in failing to instruct the jury that it was required to unanimously agree on which source of income that Fxxxx failed to report on her income tax return; and (3) the district court improperly calculated Fxxx's Guidelines range and imposed a substantively unreasonable sentence."

The jury convicted based on unreported income from individuals, payments for parties and unreported tips at a strip club.

"Fairchild argues that her 33-month sentence is procedurally and substantively unreasonable. First, she asserts that the district court's calculation of the Guidelines range was based on an erroneous calculation of the tax-loss amount and an erroneous finding that Fxxxxx failed to report income from criminal activity. Second, she maintains that her 33-month sentence is substantively unreasonable for failing to account for the effects of past sexual abuse and her status as the sole parent to three young children."

The Defendant's own testimony during the trial indicated that she received tips during the time period in question in cash. She admitted that was not reported as income on her income tax returns, "and she stated that was just an oversight."

The Defendant also objected to the sentence enhancement since the unreported income was over $10,000 a year from illegal income - prostitution.

In a 26 page decision filed 3/17/2016 the 8th Circuit rejected all of her arguments and upheld the 33-month prison term. And of course would have to pay back taxes with large penalties for failure to report.

Source: United States Court of Appeals

For the Eighth Circuit No. 14-3517

Dave notes this reminds me of a fight I had with the IRS decades ago when I was a Tax Supervisor for a then "Big 8" CPA firm. Someone suspected of underreporting income was hit with a $1 million IRS Jeopardy assessment that was a lien on all bank accounts and assets and was outrageous. It took a long time to convince the IRS there was no unreported income and get the lien released.

COME ON Buddy, 2012: Why are you playing into this guy's drivel

...so much as it is a case of somebody who thought they could get away with tax evasion, and then they got caught.

Claiming that she forgot to report her tip income, and then claiming that all of her other income was gifts despite the fact that she is some kind of sex worker sure seems like a fatuous legal defense if you ask me. She must have a very bad lawyer or something.

Be that as it may, I am curious as to how much she failed to pay in taxes to get such a long prison term.

Be that as it may, I am curious as to how much she failed to pay in taxes to get such a long prison term.

Recent massage cases have taken pleas, as have most of the gals in the Studio case. However, the owner is taking to trial - I don't think he has any chance of not guilty and will probably get about 10 years.

The tax evasion case only got 33 months after losing at trial and appeal.

Her total income over 4 years was calculated at over $1,000,000 including husbands. She had as I recall about $250,000 of additional taxes plus probably a 50% penalty. She did report some income from sexwork but overlooked most of it.

BTW Tracy turned down a plea deal for time served and took it to trial where the potential is 70 years per Donald Advisement by the Judge (I was there). My guess is 5 but the possible range is huge depending on how they combine or not the 22 counts found guilty on. The rest of the 39 indicted took pleas and all got probation but a felony record in most cases. The last plea was about a week ago.

Obviously the answer to not paying taxes for a provider is that for every paid session she does then she needs to give a charity write off session to a disadvantaged hobbyist in order to equalize her adjusted gross income to zero.

-- Modified on 4/14/2016 12:53:15 PM

No deduction for value of services, sorry. Can only deduct value of expenses incurred in providing that service.

I seem to recall that in determining the value of taxable income, one can not deduct the cost of expenses against that income IF the activity was illicit.

True, guys/gals

Business expenses are not allowed to be claimed as deductions by drug dealers, specifically. Other illegal businesses may still claim those deductions. So whether you are engaged in the business of prostitution or contract murder, you can still claim business deductions, if you keep proper records to substantiate them.

The IRS has taken the "drug dealer" position against marijuana dispensaries, because they are selling a controlled substance as far as they are concerned. Therefore marijuana dispensaries can not claim such things rent, advertising, depreciation, legal fees, wages, utilities, and security services, which means they could very well owe a tax rate that exceeds 100% of their net income.

They way they mitigate that, is by claiming that they also do legal things like care-giving services (patient counseling, etc), and then they keep careful records to show that the business deductions are associated with the legal activity, as opposed to the illegal one.

Ironically, the most commonly heard argument to legalize marijuana in the first place sounded like this: "legalize it, tax it." Apparently the IRS was paying special attention to the second half of that statement!

True, guys/gals?

So how exactly would a provider claim this seemingly illegal income? What does she file it under?

The IRS has taken the "drug dealer" position against marijuana dispensaries, because they are selling a controlled substance as far as they are concerned. Therefore marijuana dispensaries can not claim such things rent, advertising, depreciation, legal fees, wages, utilities, and security services, which means they could very well owe a tax rate that exceeds 100% of their net income.

They way they mitigate that, is by claiming that they also do legal things like care-giving services (patient counseling, etc), and then they keep careful records to show that the business deductions are associated with the legal activity, as opposed to the illegal one.

Ironically, the most commonly heard argument to legalize marijuana in the first place sounded like this: "legalize it, tax it." Apparently the IRS was paying special attention to the second half of that statement!

True, guys/gals?

Rather than forming an opinion from the summary in the original post, read the full decision linked below.

(If the "Dave" mentioned in the last paragraph of the post is DAVEPHX himself, he must have copied the summary from someone else's post; it is strange that he did not edit the last paragraph.)

TER Trivia quiz question for the "newbies":

Anyone know what "Dave" this Dave makes clear he is not by adding "PHX" to his name?